Medium’s Seed-Stage VC’s Decision Tree

By Rob Go, Co-founder of NextView

I continue to be on a kick towards better and more systematic decision-making.

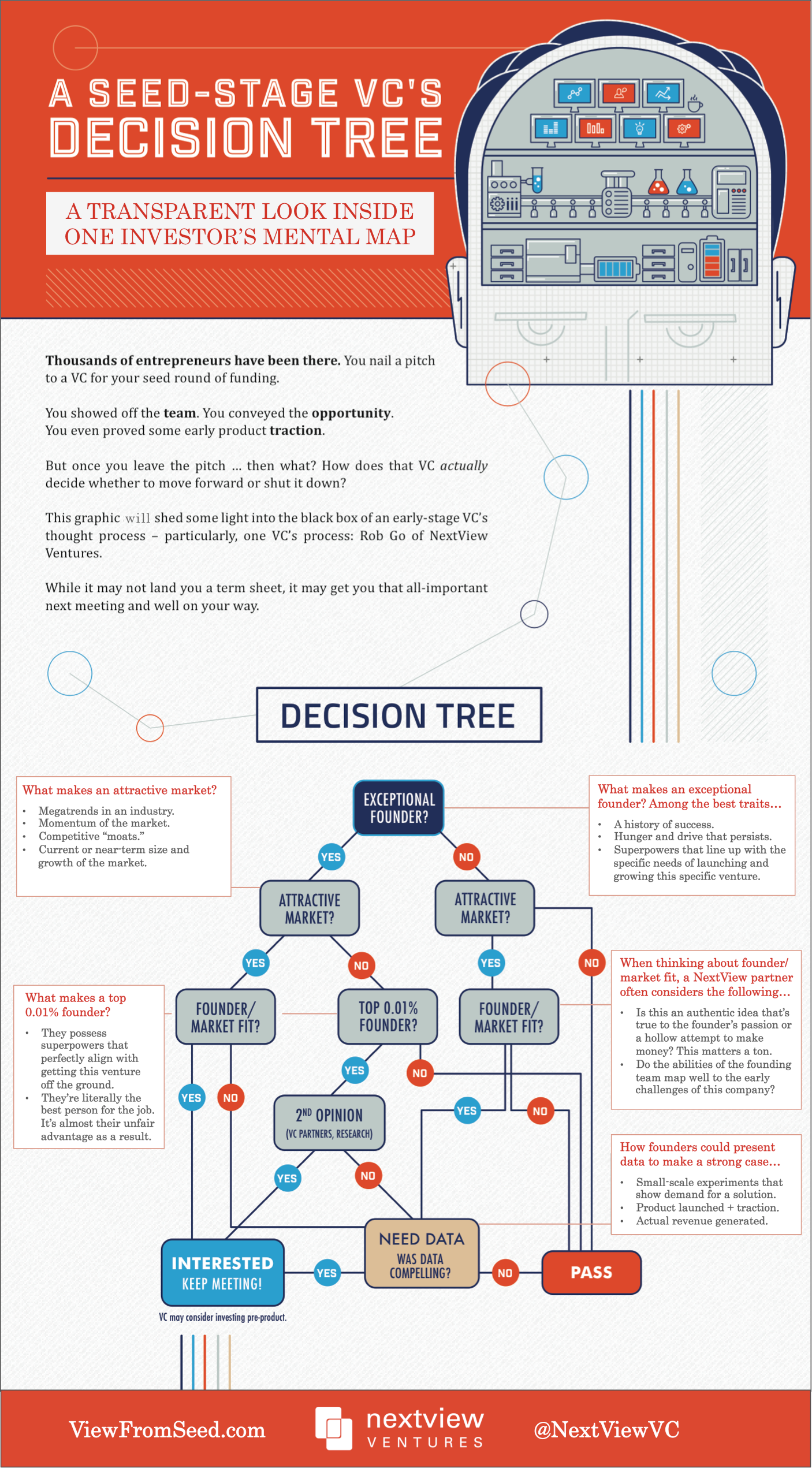

One exercise I’ve tried is to codify my mental decision-tree for early-stage investing. Essentially, it is the internal dialog I tend to have with myself when evaluating companies. But by charting it out, it helped me to be more explicit about what attributes I’m looking for, and how my opinion about different attributes feeds into an ultimate decision.

The first high-level questions I ask are:

1. Is this an awesome founder?

2. Is this a market I want to have an investment in? This incorporates both the total size potential of the opportunity and the attractiveness of the market itself.

3. Is there strong founder market fit? Is this an authentic idea, and does the capability of the founding team map well towards the needs of the market in the early stages of the business?

Here is the tree with some commentary on the different combinations below.

So, a couple combinations:

If 1 = yes, 2 = no, it’s usually a no. I’m generally a believer that markets beat teams. But that said, I’m actually typically very open minded about what markets I’d like to have an investment in.

If 1=yes, 2=yes, and 3=no, I think it’s difficult to invest pre-product and before some evidence of product/market ft. I think founder/market fit is incredibly important early on. We have invested in some companies of this profile where we loved the founder but our perception was that founder/market fit wasn’t that strong (ThredUp is a good example). But in those cases, very early metrics went a long way towards mitigating the risk.

If 1=YES YES YES then we might still move forward early on. Basically, this is the rare (0.01% of less) exception where you feel like you have HAVE to back a truly extraordinary founder. In the case where this extraordinary founder is pursuing an unattractive market, we need to ask ourselves, is this founder wrong about the market, or could we be wrong?. We still tend to have a bias that markets tend to win, but we will dig to figure out if we aren’t missing something. If the market is attractive and there just isn’t great founder/market fit, we will be open minded as well. There are just some rare entrepreneurs that you want to be in business with in almost any circumstance. But it’s definitely a very small minority. Jack Dorsey comes to mind here with Square. Not exactly founder/market fit, but it didn’t really matter.

Sub-point: Actually, in a way, Jack did have founder/market fit with square because of what the company required. His personal brand and influence in the technology industry enabled him to raise large amounts of capital with relatively little traction and get to the very top of all major financial institutions, both pretty important advantages in starting a payments company of this sort.

If 1 = Yes, 2 = yes, 3=yes, then I’d seriously consider investing pre-launch. This isn’t a formula by any means, but I find that when founders I really like are going after an authentic idea in a space I like, I’m much more willing to jump in pre-product. This describes quite a few of our portfolio companies actually. Not all will work out, but in many cases, I feel perfectly fine about having taken the plunge.

If 1 = No, 2 = yes, 3=yes, then I’d need to see some evidence of product market fit or traction. Even then, it’s really hard to get excited about an investment unless I’m really excited about the people leading the company. But I am also cognizant that how one comes off in a fundraise is not always perfectly correlated with their capabilities — and there is something about delivering results that makes you think twice about your first impressions of people. If the reason that 1=No is because of any fear of integrity or something similar, then it is really a no-go. But if it’s more of a question about capabilities, then it’s important to stay open-minded. It’s easy to underestimate people.

Of course, there is a lot more going through my mind, plus some really important “softer” considerations that are beautifully articulated by my old colleague Bijan here. The point of this post isn’t to say that this is the right way to do things or to say that I follow this approach strictly. But I did think it would be interesting for founders to see an attempt at simplifying what is usually the black box of an investor’s mind.